In this interview, Sivakumar Narayanan, Executive Vice President, Uster Technologies, talks about operational costs and practical savings for spinners. With a view to the daily reality in a mill he outlines the ‘big picture’ needed for secure investments

Uster Technologies supports manufacturers to manage their mills with quality in mind. Thinking about a spinner’s business, what are the biggest challenges?

Nowadays, yarn producers have a quality-oriented mindset and understand the benefits of customer satisfaction. However, there is a need to achieve a balance between managing the challenges related to a low demand cycle such as capital, retaining personnel and preparing for an imminent potential upswing. When market conditions are tough, quality often becomes a key purchase criterion because customers can choose from many suppliers. Our customers are trying hard to manage short-term needs, while somehow preparing for longer-term sustainability.

There must be pressure on suppliers as well due to the tough situation. Do you see capital investments happening?

Textile mills trust in technology which supports them to deliver consistent quality, and many major companies use this as an opportunity to invest in quality improvement equipment. At the same time, we also see that investment decisions – for example, in yarn clearers – can become bogged down with smaller details such as sensor technology discussions, prices and features. This can mean that the ‘big picture’ of quality and running costs – which are the daily reality after the initial investment – are totally forgotten. So, we like to build awareness on such topics, while trying to help customers prioritize investments within their unique context, and continue to support them for the future.

Could you expand further on your comment about the focus on details versus the big picture? What is missing in terms of a deep analysis for investments?

Let me give you an example. Let’s assume you are considering an investment to replace the yarn clearers on your automatic winding machines. One factor to keep in mind is that the operational costs of running a winding department with 500 winding positions could be more than USD 3.5 million over a ten-year period, at a conservative estimate. In practice, the initial investment expenditure can actually be dwarfed by the cost of splices – hundreds of thousands of them – needed over the clearers’ lifetime because of unacceptable yarn faults and bobbin changes.

Please bear in mind at the same time that the capital investment in the yarn clearer itself is a small fraction of the operational cost. Making prudent choices, it is possible to save up to USD 1 million over the same period, depending on yarn type, quality and production conditions. However, often but not always, decisions are taken with a narrow focus on the product features or price discounts and so on – which are actually a tiny fraction of the running costs. This approach actually hides the really important issues and unfortunately leads to negative surprises when starting to use the equipment.

What would you recommend to assure profitable investment?

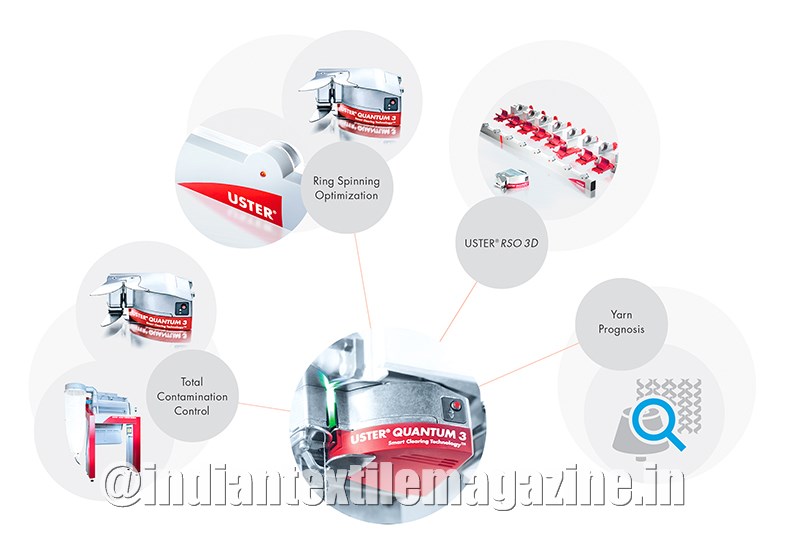

As a general principle, I would advocate greater awareness of operational costs and savings opportunities. This is really the bigger picture to consider. Evaluation of investments should factor in the differences in operational costs between competing choices, instead of focusing too much on small differences in the initial capital cost. For example, Uster Technologies recently introduced the idea of preventive yarn clearing with the idea of preventing faults being produced instead of cutting them out at winding. This can, for example, result in large operational cost savings, while the initial capital differences are not critical. Substantial savings, equal to one-third of operational costs, can be achieved with Uster Quantum 3® alone. These savings can be even greater when combined with other inline quality monitoring devices such as those for ring spinning or fibre cleaning.

Does this seem like a sure return on investments?

Yes, it could be. For example, with the preventive yarn clearing concept, Uster Technologies focuses on three critical points. First, we want to empower spinners in delivering the right quality, consistently, day and night. Secondly, the required quality has to be achieved with the lowest number of unnecessary splices (costs). Thirdly, defects must be prevented at source. In the context of our discussion, when investing in a yarn clearer, for example, it would be useful to understand the consequences – both financial and in terms of quality reputation – of such an approach against the alternatives, before negotiating the initial capital cost.

The return on investment calculation might look good when considering price instead of the three reasons you have just mentioned. Does it work for other areas as well?

It does. For example, in a contamination removal system, it might be worthwhile to assess the cost of cotton ejections over a few years and examine ways to help reduce this cost, while keeping quality consistent. This can often save hundreds of thousands of dollars. For ring monitoring systems, it might be useful to question the actual purpose of the investment: ring monitoring or ring spinning optimisation? The focus on monitoring could rightly be regarded as a very limited objective, while optimisation would have implications to a magnitude of several million dollars.

That is an interesting angle. So, for long-term profitability, it’s essential to look more closely at operational costs as well as capital expenditure?

Operational expenditure and capital expenditure are two totally different aspects of a new investment decision. The operational expenditure approach requires a closer look while considering large investments. It’s essential to find the real drivers of running costs and take product lifecycle into account to calculate the savings. This might be highly relevant in today’s difficult market environment – but it would be no less important even in better times. At Uster Technologies, we are keen for our customers to prosper today as well as tomorrow, and will always be there to help them make informed decisions.