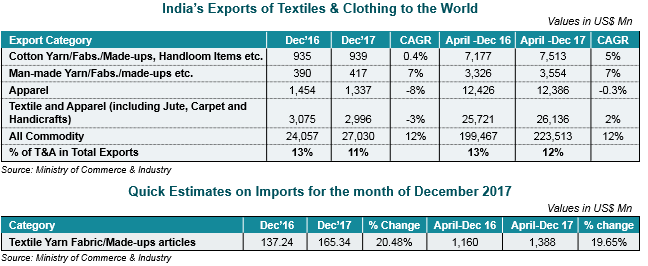

With the release of foreign trade data for December 2017 by the Ministry of Commerce & Industry, Mr. Sanjay Kumar Jain, CITI Chairman, has expressed concern over the 3% decline in CAGR in textiles and apparel exports compared to the corresponding period of December 2016. Exports of textiles and apparel stood at $2996 million in December 2017 as against $3075 million in December 2016. However, the cumulative export has slightly improved by 2% CAGR as the exports stood at $26,136 million in April-December 2017 in comparison to $25,721 million in April-December 2016.

Mr. Jain further stated that the share of textiles and apparel exports in the All Commodity Exports (ACE) also declined by 2% in December 2017.

A comparative statement showing the sector-wise performance is given below:

Mr. Sanjay Jain, while appreciating the cumulative increase in the textiles and clothing exports during April-December 2017, also expressed concerns over the consistent increase in imports of textiles and clothing during the same period. Imports during December 2017 stood at $165.34 million as compared to $137.24 million in December 2016, registering an increase of 20.48 per cent.

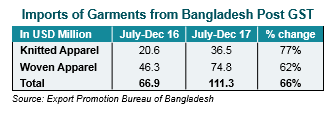

Mr. Jain further pointed out that as per the latest statistics released by the Export Promotion Bureau of Bangladesh, India’s imports of garments from Bangladesh reached $111.3 million during July to December 2017, indicating a sharp rise of 66% from $66.9 million during the same period last year.

The data regarding imports of garments from Bangladesh post-GST is illustrated in the table below:

Mr. Sanjay Jain also stressed that the ongoing scenario is negatively affecting the domestic yarn, fabric and garment manufacturers. There is a greater need now to impose safeguard measures such as Rules of Origin and Yarn Forward and Fabric Forward Rules on countries like Bangladesh and Sri Lanka that have FTAs with India to prevent cheaper fabrics produced from countries like China routed through these countries. Garment manufacturers in India have to pay duty on imported fabrics, while Bangladesh can import fabric from China duty free and convert them into garments and sell to India duty free. This is putting the Indian garment industry at a major disadvantage.

At the same time, he pointed out that India can increase its exports of cotton yarn and fabrics provided the sector is restored with export incentives. CITI has been strongly representing the case of cotton yarn and fabrics with every Government department, including PMO, to enhance the competitiveness of the cotton yarn and fabric sector.

At present, India’s share of cotton yarn in world trade is 26% and it is declining steeply as the incentives given to the cotton yarn sector were withdrawn in 2014 and MEIS, which was extended to the entire value chain was not extended to cotton yarn.

Moreover, there are various State levies up to the tune of 8% on cotton yarn which are not refunded at any stage. Similarly, the fabric sector is not getting refund of State levies of around 6%. By including cotton yarn under MEIS and providing ROSL for fabrics, Indian can retain its competitiveness in the global market.

He has also stated that he is optimistic that the Government would consider CITI’s representations and resolve the issues of the textile and clothing sector on an urgent basis.