In conversation with: Mr. Bruce Atherley, Executive Director, Cotton Council International (CCI)

Increasing consumer focus and demand for sustainably manufactured textile products, post COVID crisis

Cotton Council International (CCI) is a non-profit trade association that promotes U.S. cotton fiber and manufactured cotton products around the globe with the COTTON USA™ Mark. India has been one of the key markets for U.S. cotton for around three decades now. CCI has always been proactively working with mills through its various initiatives, whether it is in the field of improving sustainability, stepping up efficiencies and quality of their end-products. It has through its flagship COTTON USA™ licensing program helped mills to identify and label their superior products made out of U.S. cotton.

In an exclusive interview, Mr. Bruce Atherley, Executive Director, CCI, threw light on a variety of topics including the impact of the Covid-19 pandemic on consumer demand for cotton, U.S. Cotton Trust Protocol, the relationship of U.S. cotton with the Indian market, and factors driving demand for U.S. Cotton, among others.

Here are the edited excerpts.

The COVID crisis has significantly impacted consumer demand and preferences. What has been the impact on U.S. cotton?

The COVID-19 pandemic has caused unprecedented disruptions in the supply chains and markets for the U.S. and world cotton and textile industries. The collapse in cotton demand has been felt across the U.S. cotton industry from textile manufacturers to cotton producers, and all segments in between. The global outbreak resulted in disruptions in all U.S. cotton export markets, with forced closures for many factories and/or drastic reductions in orders and cancellations for others. In addition to the sharp drop in demand and resulting price pressure, each segment of the U.S. cotton industry has faced business disruptions as a result of efforts to contain the pandemic. The COVID-19 pandemic devastated textile supply chains as retail outlets shuttered their doors. Billions of dollars of orders were cancelled, and manufacturing facilities in key markets for U.S. yarns and fabrics closed as countries implemented a full lockdown.

Prior to the COVID-19 pandemic, world mill use for the 2019 crop year was estimated to be 121 million bales. In the August WASDE report, USDA estimated world mill use for the 2019 crop year at 102 million bales, almost 20 million bales lower than the estimates prior to the COVID-19 outbreak.

In the United States and abroad, the combined impacts of government-mandated business closures and cancellations of orders by major brands and retailers have resulted in drastic losses in cotton. The merchandising and distribution channels have been faced with increased costs due to storage, interest, insurance, and other carrying costs associated with the delay of commodity merchandising and consumption.

Despite the widespread availability of online shopping for clothing and textile products, the uncertainty surrounding the COVID-19 pandemic caused many consumers to limit spending on non-essential items. The reduced sales and store closures led to massive layoffs in the U.S. retail apparel/textile industry.

U.S. Cotton Trust Protocol…Can you explain what this initiative is all about and how it helps textile mills and brands?

Aligned with the U.N.’s Sustainable Development Goals, the Trust Protocol is a complement to existing sustainability programs. It is designed from the ground up to fit the diverse cotton growing landscape of the United States in an effort to drive industry-wide goals for continuous improvement.

The U.S. cotton industry continues to use and develop innovative technologies, adopt best management practices, and fund research projects that will help develop new farming practices globally. Trust Protocol members will be working with participating growers to help drive continuous improvement among six key elements of sustainability: land use, soil carbon, water management, soil loss, greenhouse gas emissions, and energy efficiency.

Trust Protocol metrics can be used for sustainability reporting, ESG audits and GRI standards reporting purposes among others. By way of example, Trust Protocol data could be used by a member to help document progress toward achieving certain science-based sustainability targets and/or in meeting the member’s commitments or contributions toward the U. N.’s Sustainability Development Goals.

As a participant in the Trust Protocol, mills and manufacturers can get the critical assurances they need to prove to their customers that the cotton fiber they source, and sell is more sustainably grown with lower environmental and social risk. Mills and manufacturers will gain access to U.S. cotton with sustainability credentials proven via Field to Market via the FieldPrint Measurement Analysis and verified by Control Union Certifications.

How has the year 2020 been so far for U.S. cotton?

U.S. Mill Use & Retail Demand

The closures and/or reduction in orders for most U.S. textile production facilities resulted in a significant drop in cotton consumption for the 2019/20 crop year. USDA’s latest estimate for U.S. mill consumption for the 2019/20 crop year is 2.2 million bales as compared to 3.0 million bales in 2018/19. While retail demand is slowly recovering, U.S. mill use is not expected to fully recover during the 2020/21 crop year.

U.S. Exports

U.S. exports for the 2019/20 crop year were lower than pre-COVID projections resulting in a higher level of ending stocks. U.S. merchants were faced with weak demand and export cancellations as a result of the COVID-19 pandemic. The Phase I trade agreement with China was expected to increase exports of U.S. cotton in 2020. However, the timing and quantity of additional Chinese purchases is highly uncertain given the market disruptions created by the COVID-19 outbreak.

U.S. cotton Prices & Acreage

In a matter of weeks, the COVID-19 outbreak resulted in a 30% crop in U.S. cotton prices. Prior to the pandemic, the December 2020 NY futures contract was trading in the low 70s. In mid-April, futures prices were trading in the low to mid 50s. The sharp decline in futures prices provides a perspective on the increased market exposure facing the U.S. cotton industry. The COVID-19 pandemic’s slowdown in cotton demand adds additional carrying costs that include storage, interest, insurance, demurrage, detention, additional interior and ocean freight costs associated with destination displacement, and other costs.

Unfortunately, the drastic decline in cotton prices and the increased uncertainty in commodity markets are damaging an already tenuous economic situation for producers. Given the price situation, U.S. producers planted less cotton in 2020. U.S. producers planted 12.2 million acres in 2020 as compared to 13.7 million acres in 2019. For the 2020/21 crop year, cotton prices are not expected to improve given the weak demand and large world cotton stocks. The current U.S. and world supply and demand fundamentals point toward a very bearish outlook for average U.S. cotton prices.

Which are the key global markets for U.S. cotton?

The top global markets for U.S. cotton are Vietnam, China, Pakistan, Turkey, Bangladesh, Mexico, and Indonesia. In recent years, Vietnam has emerged as the largest global market for U.S. cotton. Bangladesh is an emerging market and continues to become a larger importer of U.S. cotton. U.S. mills are also one of the largest markets for U.S. cotton.

U.S. cotton has a rich historical relationship with Indian textile industry dating back to many decades…Can you look back on U.S. cotton’s relationship with textile mills in India?

The U.S. cotton industry’s relationship with the Indian textile industry is close to three decades. Cotton Council International (CCI) began its journey in India in 1994 when it first visited India, primarily to get the sense of the market and to develop contacts and understand the dynamics of textile industry and trade in India. CCI, along with Cotton Incorporated, has been spearheading the promotion of cotton when it launched the Cotton Gold alliance program in India. CCI’s objective in India was to productively engage with the textile mills and develop relationships with the textile leadership in India. India ranks No. 2 only after China in the mill consumption of cotton. Presently we have a flagship COTTON USA™ licensing program for the mills which helps them to identify and label their superior products made out of U.S. cotton. CCI has more than 40 COTTON USA™ licensed mills in India encompassing the entire value chain from spinning to weaving and knitting, including all the major product lines in apparel and home fashion. CCI program has seen a major transformation in the last three years, as we now have a dedicated technical team who is supporting the textile mills to improve their productivity and get a better value on the fiber and enhance the product features. CCI has been hosting seminars focusing on the recent developments in the textile and trade. CCI’s campaign “What’s New in Cotton” was aimed at bringing innovations to the area of U.S. cotton textiles. CCI’s Mill Exchange Program has been appreciated by the mills, as they are able to exchange the ideas and best practices in the spinning industry across the globe.

How has been the growth in import of U.S. cotton in the Indian market in recent years? What are the factors driving increase in demand?

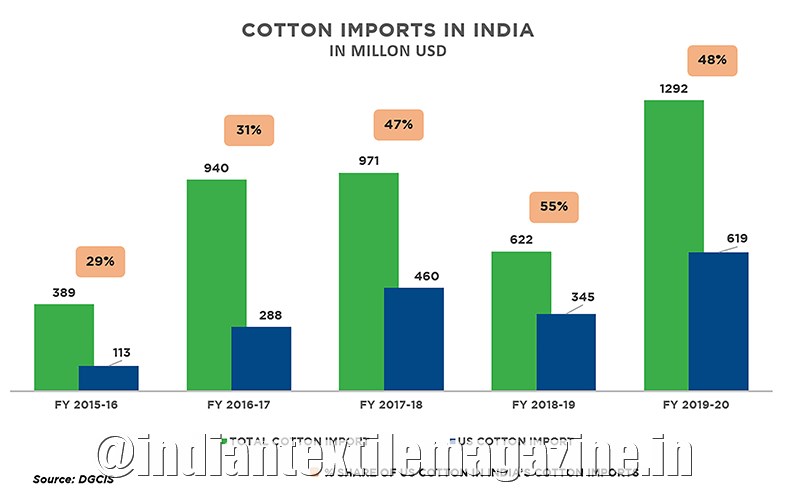

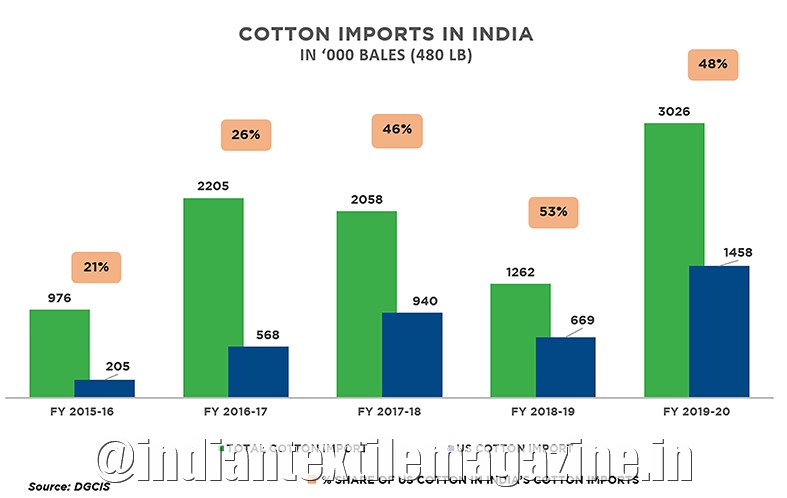

If we look at the trends in exports of U.S. cotton to India, the average annual exports for the period 2009-2014 were 146,000 bales (1 bale = 480 lbs) which has now grown to 700,000 bales annual average for the period 2015-2020. As the mills experience the use of U.S. cotton, we expect the usage to grow in the coming years.

Global brands and retailers have always looked toward India for textile products, especially made from cotton. The textile mills have been seeking the fiber that can enhance the characteristics of their products and also deliver better value to their businesses. As India is one of the largest cotton yarn exporters, U.S. cotton has been a key ingredient (and the first choice) when mills need to export high quality yarns. India has been amongst the top two users of Supima cotton. The other key factor that has prompted the use of U.S. cotton is the demand for verified cotton, and Permanent Bale Identification (PBI) provides the inherent traceability which is further verified through our COTTON USA™ licensing program.

Given that a textile mill in India has many options for sourcing cotton globally, Why should he consider U.S. cotton?

If we look at the share of U.S. cotton in the Indian cotton imports in last three years, every second bale of cotton that is imported in India is of U.S. origin. One of the key factors associated with U.S. cotton is “TRUST.” COTTON USA has become the cotton the world trusts because of years of transparent partnership. The U.S. is the first country in the world to test 100% of the bales, which ensures that mills get what they order. This is a testimonial of our commitment to excellence and customers’ satisfaction.

Sustainability, quality, transparency and the premium value of U.S. cotton fiber has created the preference for U.S. cotton. When mills, manufacturers, brands and retailers want strong, consistent and uniform fibers, they seek U.S. cotton fibers. Since the mid-1980s, the U.S. cotton industry has undergone an enormous transformation. Intensive research and superior technology has produced a cotton product that’s now whiter, finer, stronger and cleaner. The passion of our growers to constantly innovate is further driving the improvements in the fiber.

COTTON USA goes above and beyond to benefit the mills’ business. COTTON USA is committed to create programs, networking opportunities and educational forums that benefit mills, manufacturers, brands and retailers. It’s all a part of the premium value that U.S. cotton brings to the entire supply chain. The dedication of COTTON USA to help building closer relationships between suppliers and buyers benefits the entire industry.

What are the guidelines and audit procedures adopted with member mills in terms of proper usage of U.S. cotton? Are there traceability technologies used to trace the origin of the fiber?

As mentioned earlier we have a COTTON USA™ licensing program which has a very robust system to verify the cotton in the textile supply chain. Every U.S. cotton bale has its own Permanent Bale Identification (PBI) Tag. As each bale goes through the ginning and classing process, this tag goes along with it. So you always know where, when and how it was harvested, ginned and classed. At COTTON USA, we know consistency equals productivity, so we use the latest computerized HVI and PBI technology to class every bale to our high, exacting standards.

COTTON USA™ has also signed a partnership with Oritain™ to provide industry leading, forensic verification of origin for all U.S. cotton. A global first for the cotton industry, this collaboration will give brands and retailers the assurance they need to make responsible sourcing and purchasing decisions.

This partnership with Oritain will provide COTTON USA with a unique selling point in both domestic and export markets. Now U.S. cotton will offer the highest level of end-to-end traceability in the industry, combined with a raw material that is leading the way in terms of sustainable practices – two things that global clothing brands now demand from their suppliers.

With increasing focus on sustainability, traceability and more recently with COVID the increased focus on health and hygiene…do you expect an increase in demand from brands and retailers insisting on usage of U.S. cotton?

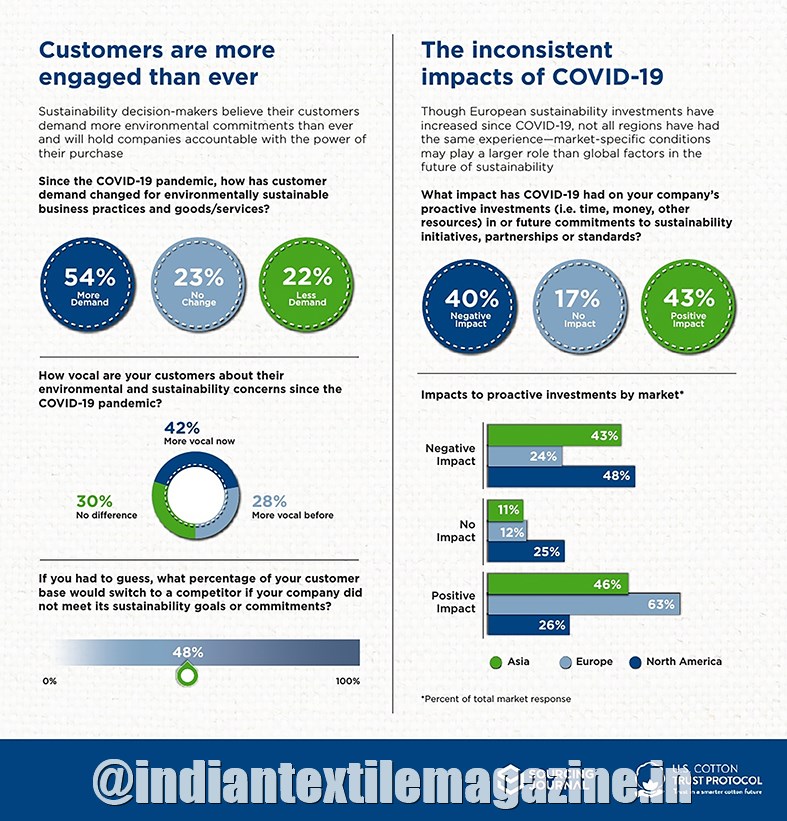

The U.S. Cotton Trust Protocol recently conducted a survey to find how sustainability programs at brands and retailers had changed in a post-COVID world. A recent global survey shows 54 percent of sustainability leaders at apparel and textile brands say they’ve seen their customers’ demands for environmentally sustainable practices and products increase since the beginning of the COVID-19 pandemic.

Fifty-four percent of respondents said that their customers’ demands for more environmentally sustainable practices and products has “significantly” or “somewhat” increased since the beginning of the pandemic, and 42% said that those customers are also more vocal in those demands. Almost half of all respondents seemed to believe that their customers are more likely to hold them accountable at the register for those actions – almost half (48%) said they believed customers would switch brands if their company didn’t meet its sustainability commitments.

It’s clear that COVID-19 has caused economic challenges up and down the supply chain, but this survey shows that companies and their customers remain focused on sustainability said Dr. Gary Adams, President of the U.S. Cotton Trust Protocol.

As we enter recovery in many countries, systems like the Trust Protocol will be more important than ever so brands can have the data they need to show they are meeting their science-based targets, Dr. Adams added.

Beyond manufacturing and exports of textiles and apparels, India has a huge domestic market which is expected to grow significantly over the next decade. How is U.S. cotton planning increase its presence from a retail perspective?

Last few years have seen a major shift in the textile market in India, more 2/3rd of the contribution now comes from the domestic market which has been growing at a tremendous pace. CCI has been working with the leading domestic brand and retailers in India, and these brand and retailers are labelling their premium products with the COTTON USA™ Mark. In 2019 more than 2 million products carried COTTON USA™ Mark in the Indian clothing retail space. CCI also conducted third party COTTON USA™ Hang Tag research in 2017, which found that 90% of Indian consumers preferred to purchase a sweater or towel with the COTTON USA™ hang tag as opposed to a generic “100% cotton” tag. Indian consumers love to choose the fabrics and then have them stitched, understanding the importance of made to measure and consumers’ affinity for touch and feel. This led COTTON USA to partner with some of the leading brand and retailers who have very high quality standards and strong associations with Indian consumers. The first COTTON USA product line was high quality shirting fabrics, which then expanded to U.S. cotton knit shirts and trousers.

“As a participant in the Trust Protocol, mills and manufacturers can get the critical assurances they need to prove to their customers that the cotton fiber they source, and sell is more sustainably grown with lower environmental and social risk

– Mr. Bruce Atherley

“India ranks No. 2 only after China in the mill consumption of cotton. Presently we have a flagship COTTON USA™ licensing program for the mills which helps them to identify and label their superior products made out of U.S. cotton. CCI has more than 40 COTTON USA™ licensed mills in India encompassing the entire value chain from spinning to weaving and knitting, including all the major product lines in apparel and home fashion.

– Mr. Bruce Atherley