Mr. Manoj John, Vice President- Strategic Initiatives, Sutlej Textiles and Industries Ltd

In the aftermath of the Covid-19 pandemic, the Indian textile industry has immersed itself in introspection of its strengths and weaknesses in the backdrop of opportunities that are likely to be presented in the altered global textile trade equation. A few dominant themes have emerged out of this process:

- Capitalise on the global trade trend (led by the US & Japan) to shift the dependency of sourcing from a single country ‘China’.

- Build capability and capacity in man-made fibre (MMF) textile products such that India can capture any market that can be weaned away from China.

- Focus on high value addition, investment in technology, product development to ensure that Indian textile products are not forced to compete in low-margin categories.

A unifying thread that connects these themes is a strategic shift to MMF textile products that offer strong growth potential supported by growing domestic market demand and emerging export opportunities. The key to success is focus on technology-intensive and high value-added products that inherently offer better profit margins and builds competitive advantage.

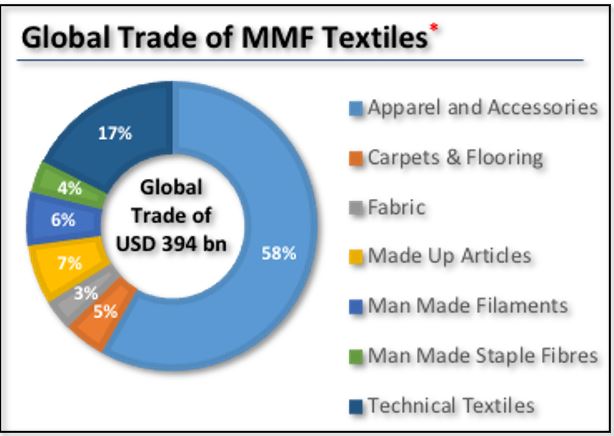

A detailed analysis of global trade data for MMF Textiles indicates that 266 products constituting of fibres, yarns, fabrics, apparels, made-ups, technical textiles and specialised articles contributed to trade of US$ 394 Billion in Yr. 2019.

- Top 20 of these products contribute to global trade of US$204.4 Billion.

- Top 40 of these products contribute to global trade of US$275 Billion.

Segmentation of global trade (by value) of Top-40 MMF products indicates that Apparels & Accessories constitute 55%, and balance 45% products are technical textiles, made-ups, fabrics, yarn and specialised products.

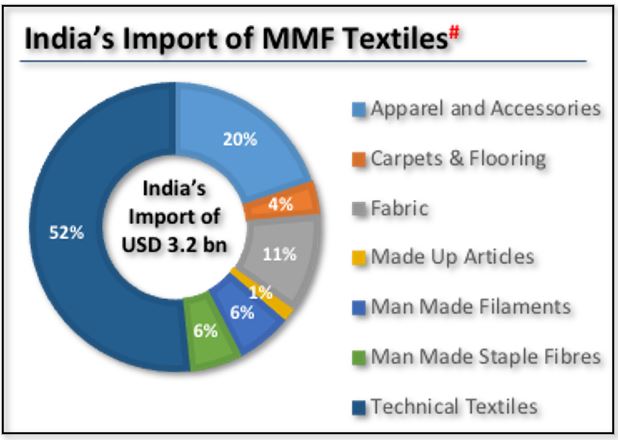

The Opportunity Analysis for Indian Textile industry (excluding Apparels) can be further refined by overlaying the imports of MMF products into India.

- The largest imported product group is fabrics which are impregnated, coated, covered or laminated with polyurethane, poly vinyl and other materials.

As a Top-40 MMF Global Trade product and the largest MMF imported product, there is a big opportunity for import substitution and exports.

- The second biggest category of MMF products imported into India are synthetic knitted fabrics including dyed and printed sub-categories. These fabrics are used for sportswear and casual wear garments.

- A related product group of MMF imports are synthetic fabrics – knitted and warp using elastomeric yarn (>5%) is. These fabrics are specifically used for sportswear/active wear garment manufacturing.

The large domestic supply gap for these specialized fabrics offers a potential investment opportunity.

- Curtains, incl. drapes, and interior blinds as made-up articles; this product category is dominated by China with 57% share of global exports.

India has the opportunity to enhance its exports as domestic MMF fibre production becomes more competitive. - Carpets and other textile floor coverings; tufted, woven of nylon, other polyamides, other man-made textile materials. Investment in targeted sub-categories and application segments offers opportunity in domestic market, and also increase the share in global exports.

- Nonwovens fabrics ‘Roll-Goods’ which are impregnated / coated / covered or laminated of varying thickness (<25gsm to >150gsm).

Certain specialty non-woven fabrics like melt-blown are mostly imported, which offers import substitution opportunity. Global scale of production can also open up export markets.

Domestic market supply gap also exists in the following:

- Significant imports are happening in high tenacity yarns (filament, monofilament less than 67 decitex), of textured polyester, nylon, or other polyamides, of aramids, textured or not

- Trims & Accessories for garment manufacturing are not produced in required quantity & quality in India

The short-term economic adversity caused by the pandemic is packaged with a long-term opportunity for Indian textile industry. The timing can’t be better to realign the industry focus towards MMF textiles. The investment decision need not be based on speculative market share of global trade; there is adequate support in the growing domestic market which de-risks the returns for an investor. The Indian government is also chipping in through its corporate tax reforms which makes India a very attractive investment destination, Special Economic Zones targeting foreign investment, removal of anti-dumping duty on PTA, and allocation of Rs 1,480-crore for National Technical Textiles Mission. The ‘call to action’ is now directed at the textile companies to make a firm commitment with a long-term view of growing the MMF category.

Mr. Manoj John leads the Strategic Initiatives department at Sutlej Textiles, with a mandate to identify growth opportunities for investment, prepare feasibility studies & business plans, lead project implementation task force, and establishing business partnerships..